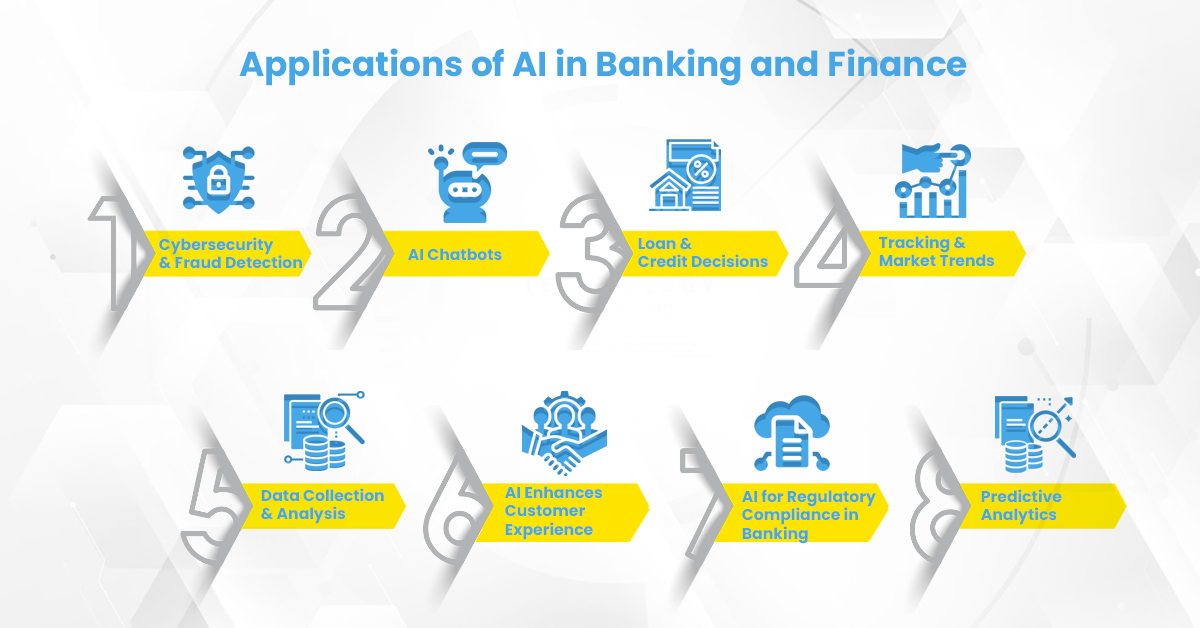

Applications of AI in Banking and Finance

Initially, AI was majorly used for increasing operational efficiency. This has changed post-pandemic where AI is used for automating processes and deriving insights. Here are the 8 major applications of AI in banking.

Cybersecurity & Fraud Detection

AI along with machine learning is capable of easily identifying fraudulent activities and alerting customers and banks. In 2019, the financial sector was the most targeted industry for cyberattacks accounting for 29% of the total. AI can be a game-changer in the finance sector to stop cyberattacks.

AI Chatbots

By combining chatbots with banking apps, the banks will be available for the customers round the clock 24*7. Chatbots’ capability to comprehend customer behavior helps in offering personalized customer support and recommending the right financial services and products accordingly.

No comments:

Post a Comment