Cybersecurity has been the major area of concern throughout 2022 and now 2023 is all set to witness a new version of cyber-attacks with advanced technologies. Cyber-criminals are ready to exploit the technological trends and hunt away into your security domain.

As we transition to a digital economy, cybersecurity in banks is becoming a serious concern. Leveraging methods and procedures created to safeguard our data are essential for a successful digital revolution. The effectiveness of cybersecurity in banks determines the safety of our Personally Identifiable Information (PII), and by extension, ourselves, whether it is an unintentional breach or a well-planned cyberattack.

Current State of Cybersecurity in Banks

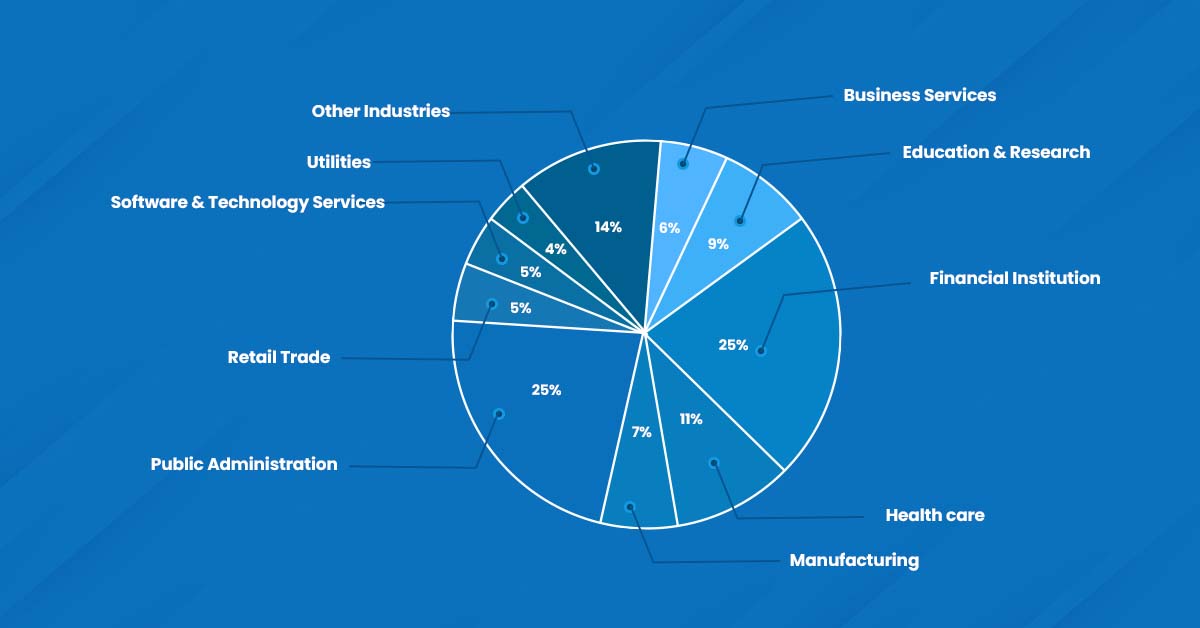

According to the S & P Global study on the share of cyber incidents reported across industries in the past years, financial institutions have topped the list and experienced more than a quarter of such security issues.

To make a comparison, the BFSI sector experienced 26% of these cybersecurity incidents, compared to the Healthcare (11%) Software and Technology Services (7%) and Retail (6%), and Retail (6%).

The volume of cyber threats is increasing fast, which shows how critical cybersecurity is to banks today. Particularly for small financial institutions and credit unions that lack the resources to survive, cyber-attacks can be very expensive to endure. Additionally, such financial institutions may suffer catastrophic reputational damage.